A strong uptrend can show numerous bearish divergences before a top actually materializes. As a leading indicator, chartists can look for overbought or oversold conditions that may foreshadow a mean reversion. Similarly, bullish and bearish divergences can be used to detect early momentum shifts and anticipate trend reversals. The CCI was originally developed to spot long-term trend changes but has been adapted by traders for use on all markets or timeframes. Trading with multiple timeframes provides more buy or sell signals for active traders.

In this type of strategy, traders need to constantly monitor the levels of the price so that they could spot the overbought or oversold periods. During an overbought zone, the possibility of a price decline is very high. Conversely, due to an oversold market, the price is more likely to reverse and go higher. The CCI indicator is calculated by following a specific sequence of steps. The core element of the calculations is to first determine the difference between the current price of an asset and the average value of prices within a specific period. Then this result is compared with the average difference over the same period.

What Are The Advantages of Using The CCI indicator?

The best way to understand how CCI indicator works is by learning how it is calculated, as it will give us a better idea about how this indicator can help us in our trading. If there are pullbacks, this means the indicator isn’t as strong, and a potential reversal might be behind the corner. If we should highlight one thing the CCI indicator is best at, it is identifying the strength of the upcoming event. It is essential to test how your strategy reacts to the indicator’s changes with paper money before applying it within your real account. If you set the period to less than 14, the line will get more reactive. Alternatively, it will be more sensitive to price information and fluctuate way more between the boundaries without breaking the lines for too long on either side of the spectrum.

Ethereum (ETH) Market Analysis – Bearish Outlook as of June 20 … – CryptoGlobe

Ethereum (ETH) Market Analysis – Bearish Outlook as of June 20 ….

Posted: Tue, 20 Jun 2023 07:00:00 GMT [source]

The CCI indicator can inform the trader about various market developments. The list includes overbought and oversold price levels, divergences, and emerging trends. It also provides insights into the price momentum and its strength, making it one of the most complete technical trading indicators. https://trading-market.org/a-hybrid-stock-trading-framework-integrating-technical-analysis-with-machine-learning-techniques-2020/ The CCI indicator is an oscillator tool that is very popular amongst investors. It can be applied in the trading of all assets such as cryptos, commodities, shares, etc. Moreover, it is an efficient technical tool that helps traders to find the overbought and oversold areas on the trading chart.

How to use CCI in Forex Forex trading

The CCI indicator (Commodity Channel Index) is one of many oscillating trading indicators and many of them are pretty similar. The CCI indicator is good, but there are better, for example, the RSI indicator. Based on the simulations we decided to backtest the CCI indicator by using a 9-day lookback period and a buy threshold of -90. However, this is a backtest that might be susceptible to curve fitting.

As with every technical trading indicator out there, the CCI also has its pros and cons. Let’s take a look at the advantages and disadvantages of the indicator. This will help you understand what you should look for when using it and improve your trading strategy.

How To Use Risk/Reward Ratio Effectively In Forex Trading

This strategy does not include a stop-loss, although it is recommended to have a built-in cap on risk to a certain extent. When buying, a stop-loss can be placed below the recent swing low; when shorting, a stop-loss can be placed above the recent swing high. When the CCI is above +100, this means the price is well above the average price as measured by the indicator.

When we get a CCI reading above the +100 level, that shows statistically the EUR/USD gained more strength than average and therefore great for buying opportunities. So, we go one step forward to find an entry signal day trading with the CCI. Like any technical indicator, the CCI indicator also has some limitations. You need to use them in combination with your price action reading skills.

Bitcoin (BTC/USD) Price Analysis Report – 4 July 2023 – CryptoGlobe

Bitcoin (BTC/USD) Price Analysis Report – 4 July 2023.

Posted: Tue, 04 Jul 2023 06:41:00 GMT [source]

Obviously, a 20-day CCI is not suited for long-term signals; chartists should use weekly or monthly charts for those. CCI moved below -100 on 22-January (8 days later) to signal the start of an extended move. Similarly, the stock bottomed on 8-February and CCI moved above +100 on 17-February https://day-trading.info/everfx-reviewis-everfx-a-scam-or-legit-forex/ (6 days later) to signal the start of an extended advance. CCI does not catch the exact top or bottom, but it can help filter out insignificant moves and focus on the larger trend. The Commodity Channel Index (CCI) can be used as either a coincident or leading indicator.

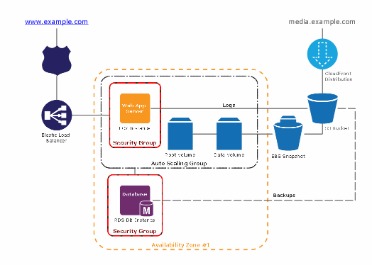

The number of CCI periods is also used for the calculations of the simple moving average and Mean Deviation. It is extremely important, as with many trading tools, to use the CCI with other indicators. Pivot points work well with the CCI because both methods attempt to find turning points.

How does the Consumer Confidence Index in the US work?

On the chart that is demonstrated above the price of the asset is moving up where both the price and the PSAR are above the 20 EMA line. While the asset’s price moves to lower levels a bullish reversal in the PSAR line is monitored at the same time. Additionally, the CCI remains over the +100 value, indicating an existing strong trend. It should be mentioned that the bullish trend will remain as long as the asset’s price stays over the latest swing low.

A reading that is above expectations can be regarded as positive, while a reading below expectations can be regarded as negative. With that said, it not clear that a higher/lower reading automatically corresponds to a positive/negative surprise to the financial markets, discussed below. As a leading https://currency-trading.org/strategies/top-indicators-for-a-scalping-trading-strategy-2021-new/ indicator, the Commodity Channel indicator can provide us with excellent great trade signals. In other words, we need the price to make lower lows while the CCI indicator has to do higher lows. In an uptrend, we would look for higher highs in prices and lower highs reading on the CCI indicator.

The key element of its functionality is that it helps traders to find the latest price reversal zones. The weekly chart above generated a sell signal in 2011 when the CCI dipped below -100. This would have told longer-term traders that a potential downtrend was underway. More active traders could have also used this as a short-sale signal. This chart demonstrates how in early 2012 a buy signal was triggered, and the long position stays open until the CCI moves below -100.

Traders often use the CCI on the longer-term chart to establish the dominant trend and on the shorter-term chart to isolate pullbacks and generate trade signals. The Commodity Channel Index is a reliable and effective indicator, but it has its disadvantages as well. More specifically, it is good for identifying market entry points (especially in conjunction with other indicators), but it is better to use traditional signals for closing the positions. All in all, CCI is a good “team player” which shows good results in conjunction with other indicators. The Commodity Channel Index (CCI) is a technical indicator that measures the current price level relative to an average price level over a given period of time. CCI is available as a SharpCharts indicator that can be placed above, below or behind the price plot of the underlying security.

Conducted by The Conference Board, the Consumer Confidence Index (CCI) measures the degree of optimism of consumers regarding current and expected economic conditions. The more profitable exit strategy is to take profits when the CCI touches the +200 level. However, since the market will only occasionally give us such big trading opportunities we need to have a backup plan. If the retrace was weak, it means the dominant energy of the market remains up. The CCI indicator strategy reflects quite well what is happening behind the scene where the actual buying and selling pressure takes place. We want to see a weak retrace in the CCI indicator that barely goes below the +100 level, but at the same time, we need to look at the price action retracing more than the CCI did.

- While the CCI indicator uses the standard deviation to create the channel, the stochastic considers the rate of the previous prices change, which made both indicators unique in their own way.

- The CCI indicator strategy reflects quite well what is happening behind the scene where the actual buying and selling pressure takes place.

- In mathematical terms, negative differences are treated as positive values.

The CCI compares the current price to an average price over a period of time. The indicator fluctuates above or below zero, moving into positive or negative territory. While most values, approximately 75%, fall between -100 and +100, about 25% of the values fall outside this range, indicating a lot of weakness or strength in the price movement. In this way, the indicator can be used to provide trade signals when it acts in a certain way.