Note that the compounding occurs because we are raising 1 plus the interest rate r to the power of t. Under simple interest, the principal is multiplied by the interest rate so no compounding occurs. You can give this a try using our compound interest calculator to see the differences when using various methods of compounding. Laura started her career in Finance a decade ago and provides strategic financial management consulting.

- But the longer you take to pay off your compound interest debts, the higher they will become.

- Calculate compound interest on an investment, 401K or savings account with annual, quarterly, daily or continuous compounding.

- The process repeats until at the end of three years, you deposit your last $135 that will not accrue interest since you are depositing it on the same day you are checking the balance in your account.

- Hence, if a two-year savings account containing $1,000 pays a 6% interest rate compounded daily, it will grow to $1,127.49 at the end of two years.

- If compounding monthly, $1,489.85 is the total compound interest value after five years.

We can either earn 0.03% compounded daily for 365 days or 0.9125% compounded monthly for 12 months. We found the monthly interest rate by multiplying 0.03% by 365/12, but you can also use an interest rate calculator. Let’s break down the interest compounding by year with a more realistic example scenario. We’ll say you have $10,000 in a savings account earning

5% interest per year, with annual compounding. We’ll assume you intend to leave the investment untouched for 20 years. With our compound interest calculator you can calculate the interest you might earn on your savings, investment or 401k over a period of years

and months based upon a chosen number of compounds per year.

What is Daily Compound Interest Formula?

The compounded annual formula can be used for investments such as savings accounts, bonds, and stocks. «Interest on interest,» or the power of compound interest, will make a sum grow faster than simple interest, which is calculated only on the principal amount. The greater the number of compounding periods, the greater the compound interest will be. Compound interest can help your investments but make debt more difficult. Say in our previous example that we earned interest semiannually rather than annually.

Compound interest occurs when interest is added to the original deposit – or principal – which results in interest earning interest. Financial institutions often offer compound interest on deposits, compounding on a regular basis – usually monthly or annually. Compound interest causes investments to grow faster, but also causes debt to grow faster. It’s important to understand what type of interest that you are earning on investments or accruing on debt so that you can properly plan for future earnings and payments.

The same logic applies to opening an individual retirement account (IRA) and taking advantage of an employer-sponsored retirement account, such as a 401(k) or 403(b) plan. Start early and be consistent with your payments to get the maximum power of compounding. When you hit your 45-year savings mark—and your twin would have saved for 15 years—your twin will have less, although they would have invested roughly twice your principal investment.

You are unable to access investinganswers.com

More frequent compounding of interest is beneficial to the investor or creditor. The basic rule is that the higher the number of compounding periods, the greater the amount of compound interest. Next enter how much money you intend to deposit or withdrawal daily. If this calculation is for a lump sum deposit with no recurring transactions enter «Never» in the «add money» drop down. Once again, our formula calculates a future value, but we are only one step away from calculating interest. All we have to do is subtract our principal from our future value.

An investing pro can teach you about different investment options and help you make a plan with your goals in mind. And we make it easy to connect with pros in your area who teach and guide but don’t intimidate. Through the SmartVestor program, you can connect with up to five of them in your area for free and then decide who you want to work with. Sign up to get updates from MoneyGeek including how to overcome your financial headwinds, hack your finances, and build wealth. The longer you take to pay off your debts, the higher your compounding interest will be, and you’ll end up paying back much more in the end. If compounding monthly, $1,489.85 is the total compound interest value after five years.

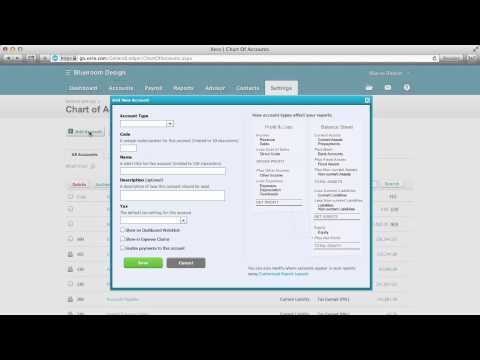

Instead of using the compound interest formula, all you have to do is plug in your numbers and information about the interest. You can utilize this tool to determine how much you will owe in interest on your debt or estimate how much you will earn in interest on your investments. Compound interest, on the other hand, puts that $10 in interest to work to continue to earn more money.

Compound interest formulas are the interest rate you earn on your money during a compounding period in a financial institution or insurance company savings account. When there’s compound interest, the money you earn each year is added to the money you already have. So, instead of just growing, the accumulated interest grows at an increasing rate which helps save for retirement or invest in stocks. Compound interest also accounts for the effects of inflation and repaying debt.

It is a powerful tool that can work in your favor when saving, or prolong repayment for debts. Compound interest is often referred to as “interest on interest” because interest accrued is reinvested or compounded along with your principal balance. It is the interest earned on both the initial sum combined with interest earned on already accrued returns. Simply enter your initial investment (principal amount), interest rate, compound frequency and the amount of time you’re aiming to save or invest for. You can include regular deposits or withdrawals within your calculation to see how they impact the future value. Let’s say you invest $1,000 in an account that pays 4% interest compounded annually.

The formula can be used when compounding annually, monthly, or at whatever time interval over which you wish to compound. The only thing you must remember is that the interest rate must match your time period. If you are compounding daily, for example, then be sure that you are working with a daily interest rate, or if you are compounding monthly, be sure that you are working with a monthly interest rate. Calculating interest on a savings account that pays compound interest, the return gets added to the original principal at the end of every compound period.

Converting Irregular Expenses Into Daily Equivalents

In order to calculate the future value of our $1,000, we must add interest to our present value. Because we are compounding interest, we must reinvest our interest earned so that our interest earned also earns interest. When we say that the investment will be compounded annually, we will earn interest on the annual interest along with the principal. Daily compounding is when our daily interest/return will get the compounding effect. The concept is such that it assumes that the interest earned every day is reinvested at the same rate and will bring an increase as time passes. That is why if we annualize the daily compound interest, it would always be higher than the simple interest rate.

Compound interest is often calculated on investments such as retirement and education savings, along with money owed, like credit card debt. Interest rates on credit card and other debts tend to Is Sales Revenue A Debit Or Credit In Business be high, which means that the amount owed can compound quickly. It’s important to understand how compound interest works so you can find a balance between paying down debt and investing money.

Three Ways To Compound Your Wealth Faster!

Simple interest refers only to interest earned on the principal balance; interest earned on interest is not taken into account. To see how compound interest differs from simple interest, use our simple interest vs compound interest calculator. Just enter your beginning balance, the regular deposit amount at any specified interval, the interest rate, compounding interval, and the number of years you expect to allow your investment to grow. In the examples used here, we are assuming the investor leaves all the interest in the account to continue earning compounding interest. If the investor withdraws some of the interest, the future value will not be as large as we have calculated because the total value earning interest has decreased.

Using our compound interest calculator, $5,000,000 invested in a fixed deferred annuity can earn up to $167,740 per year in interest over five years. The compound interest definition is earning interest on your original money and the money you save. Because interest compounds, the accrued interest allows your savings to grow faster. We provide answers to your compound interest calculations and show you the steps to find the answer.

From abacus to iPhones, learn how calculators developed over time. Many bad habits also increase stress while deteriorating health, adding additional costs not reflected in the above table. Many seemingly simple pleasures in life have dramatic longterm costs. After subtracting about 3% inflation the real returns were about 7% a year between 1927 and 2014. Free calculators and unit converters for general and everyday use.

The process repeats until at the end of three years, you deposit your last $135 that will not accrue interest since you are depositing it on the same day you are checking the balance in your account. Remember also that, because you are compounding quarterly, the annual rate must be divided by four since your deposits are earning interest every quarter. If you want to know how much interest your investment will earn, our compound interest calculator can help. Contact us today to request a service quote or learn more about our products and solutions. If the account has a lump-sum initial deposit & does not have any periodic deposit, by default interest is compounded daily.

Following is the formula for calculating compound interest when time period is specified in years and interest rate in % per annum. Learn how interest is calculated and the power of calculating compound interest over time for retirement. Find the highest interest rates for your savings, ranging from 3 months to 10 years, all in one place. Fixed annuities are almost identical to Certificates of Deposit (CDs) accounts and provide higher interest rates and penalty-free withdrawals for income.

Example investment

This is where you enter how much compound interest you expect to receive on an investment or pay on a debt. The rate of return on many investments is speculative, so entering an average number can give you an idea of how much you’ll earn over time. The rate of return you earn on your investments can make a big difference. See what the change in your balance is if you increase or decrease your rate of return by 1 or 2 percentage points.